This is the biggest mis – conception about CTC, If you understand CTC your CTC negotiation will become easily in your next Interview.

Now that you know What is CTC in salary, A high CTC can be misleading if the breakdown isn’t clear for you at the time of Interview. The most common question about CTC is, “why is take home salary different from ctc?” The answer lies in the components of your CTC salary format.

First of all, Industry use wide terms such as In-hand, take home, Net Salary they mean the same.

What does CTC means and CTC Break up format

CTC means Cost to Company is the total amount a company spends on you in a year. It includes not just your monthly salary but also contributions, benefits, and sometimes even perks you don’t see as cash in hand. CTC Break up format break up divide into –

1. Direct Benefits: This is the part that is paid directly to you, usually on a monthly basis.

2. Indirect Benefits: Benefits the company pays for on your behalf, but you don’t receive them as cash. For example, your health insurance premium, life insurance, or food coupons are all part of your CTC because they are an expense to the company.

3. Savings Contributions: This includes contributions to your retirement funds like the Employee Provident Fund (EPF) and gratuity. While these are your savings, the employer’s contribution is added to your CTC.

Why is take home salary different from CTC

The difference between your CTC and your take home salary comes from these indirect benefits and statutory deductions like Provident Fund (PF), Income Tax (TDS), and Professional Tax.

Take-home salary (Net Salary) is what actually gets credited to your bank account every month, after deductions like taxes and provident fund (PF). That’s why your take-home is always less than your CTC.

How to calculate gross salary from CTC / Gross Salary meaning

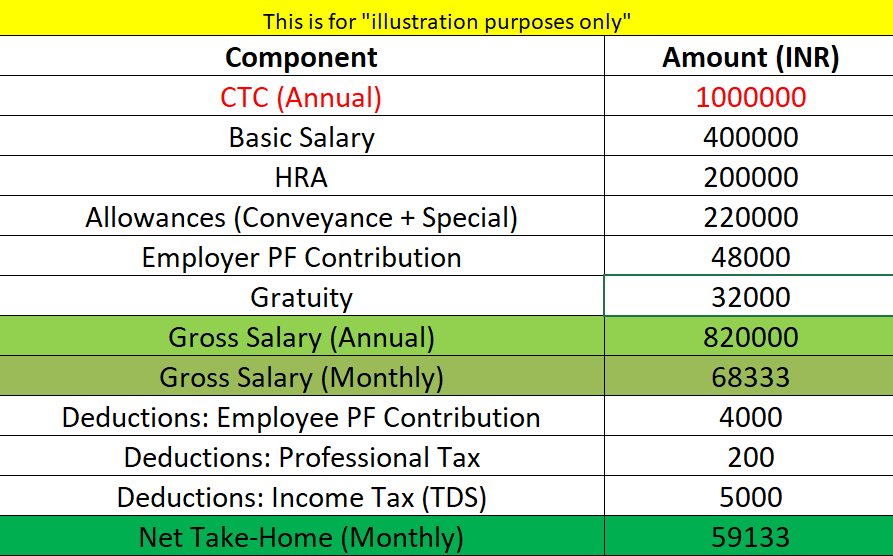

Suppose a company offers you ₹10,00,000 CTC per year. Here’s how it could look:

CTC Breakup (Annual)

- Basic Salary: ₹4,00,000

- HRA: ₹2,00,000

- Conveyance + Special Allowance: ₹2,20,000

- Employer PF Contribution: ₹48,000

- Gratuity: ₹32,000

Total CTC = ₹10,00,000

What Counts as Gross Salary?

Gross Salary = Basic + HRA + Allowances

= ₹4,00,000 + ₹2,00,000 + ₹2,20,000

= ₹8,20,000 (Gross Salary Annually)

Monthly Gross Salary

₹8,20,000 ÷ 12 = ₹68,333

(Employer PF + Gratuity are part of CTC, but not paid to you monthly as cash.)

How to Calculate in hand Salary from CTC

Gross Salary Annually – ₹8,20,000

Gross Salary Monthly – ₹68,333

Deductions from Gross

- Employee PF Contribution (12% of Basic) = ₹4,000 per month

- Professional Tax = ~₹200 (varies by state)

- Income Tax (TDS) = depends on your tax bracket; let’s assume ₹5,000 per month

Net Take-Home Salary / In hand Salary

Gross (₹68,333) – PF (₹4,000) – PT (₹200) – TDS (₹5,000)

= ₹59,133 per month credited to your account

Now, You know must have understood, CTC is 10,00,000 but In-hand Salary is ₹59,133 per month

Frequently Asked Question (FAQ)