As you understand how CTC plays a important role in interview. This is basic calculation If you want to know CTC vs In hand

You can see below basic CTC calculation from CTC to In hand salary calculator

| CTC Amount (₹) | CTC Divide 12 Months to know in hand monthly (if there is no deduction) |

|---|---|

| CTC 1,00,000 | Approx. 8,333 |

| CTC 2,00,000 | Approx. 16,666 |

| CTC 3,00,000 | Approx. 25,000 |

| CTC 4,00,000 | Approx. 33,333 |

| CTC 5,00,000 | Approx. 41,666 |

| CTC 6,00,000 | Approx. 50,000 |

| CTC 7,00,000 | Approx. 58,333 |

| CTC 8,00,000 | Approx. 66,666 |

| CTC 9,00,000 | Approx. 75,000 |

| CTC 10,00,000 | Approx. 83,333 |

| CTC 11,00,000 | Approx. 91,666 |

| CTC 12,00,000 | Approx. 1,00,000 |

| CTC 13,00,000 | Approx. 1,08,333 |

| CTC 14,00,000 | Approx. 1,16,666 |

| CTC 15,00,000 | Approx. 1,25,000 |

| CTC 16,00,000 | Approx. 1,33,333 |

| CTC 17,00,000 | Approx. 1,41,666 |

| CTC 18,00,000 | Approx. 1,50,000 |

| CTC 19,00,000 | Approx. 1,58,333 |

| CTC 20,00,000 | Approx. 1,66,666 |

CTC / Salary hike Calculator (Simple Formula)

When companies give a hike, they usually increase your CTC.

To find your new salary after a hike:

New Salary = Old Salary+ (Old Salary ×Hike %)

Example:

- Current CTC = ₹6,00,000

- Hike = 10%

- New Salary = 6,00,000+(6,00,000×10%)=6,00,000+60,000=₹6,60,000

👉 Your new CTC = ₹6.6 L P/A

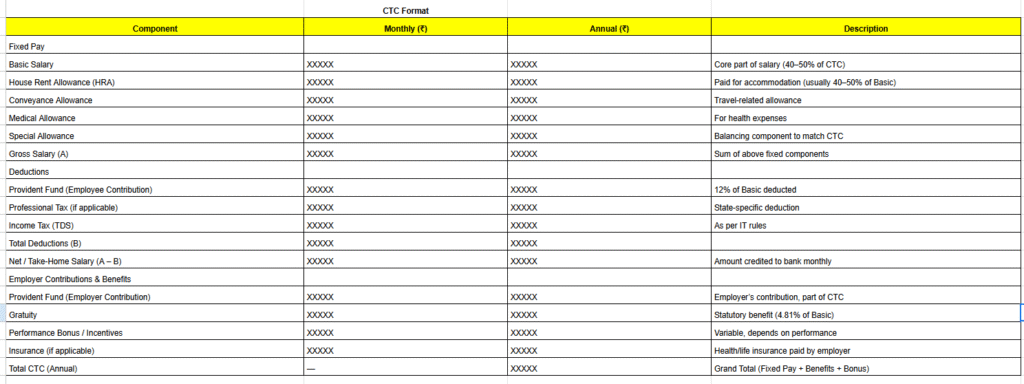

CTC Breakup Format (Tentative)

| Component | Monthly (₹) | Annual (₹) | Description |

| Fixed Pay | |||

| Basic Salary | XXXXX | XXXXX | Core part of salary (40–50% of CTC) |

| House Rent Allowance (HRA) | XXXXX | XXXXX | Paid for accommodation (usually 40–50% of Basic) |

| Conveyance Allowance | XXXXX | XXXXX | Travel-related allowance |

| Medical Allowance | XXXXX | XXXXX | For health expenses |

| Special Allowance | XXXXX | XXXXX | Balancing component to match CTC |

| Gross Salary (A) | XXXXX | XXXXX | Sum of above fixed components |

| Deductions | |||

| Provident Fund (Employee Contribution) | XXXXX | XXXXX | 12% of Basic deducted |

| Professional Tax (if applicable) | XXXXX | XXXXX | State-specific deduction |

| Income Tax (TDS) | XXXXX | XXXXX | As per IT rules |

| Total Deductions (B) | XXXXX | XXXXX | |

| Net / Take-Home Salary (A – B) | XXXXX | XXXXX | Amount credited to bank monthly |

| Employer Contributions & Benefits | |||

| Provident Fund (Employer Contribution) | XXXXX | XXXXX | Employer’s contribution, part of CTC |

| Gratuity | XXXXX | XXXXX | Statutory benefit (4.81% of Basic) |

| Performance Bonus / Incentives | XXXXX | XXXXX | Variable, depends on performance |

| Insurance (if applicable) | XXXXX | XXXXX | Health/life insurance paid by employer |

| Total CTC (Annual) | — | XXXXX | Grand Total (Fixed Pay + Benefits + Bonus) |